What is the Impact of Pip in Forex Trading?

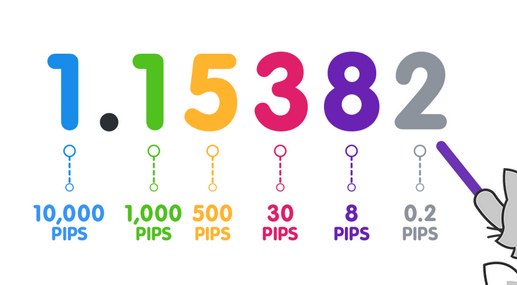

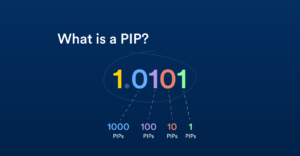

Pip in Forex Trading, a “pip” stands for “percentage in point” or “price interest point.” It is a standardized unit of measurement that represents the smallest price move that an exchange rate can make based on its decimal place. Pips are crucial for measuring price changes, determining profit or loss, and setting stop-loss and take-profit levels. Let’s break down how to count pips in forex with an example:

If

EUR/ USD moves from 1.1498 to 1.1499, that’s .0001 USD rise in value is ONE PIP.

Note – Last figures don’t show into Trading platform of many Forex Brokers

Imagine you are a new trader and you have been hearing a lot about a pip, but you do not know what it is or how to calculate one. You are feeling overwhelmed and frustrated.

Well, you have come to the right place. In this article, we will discuss what is Pip in Forex Trading and how to calculate it.

A pip is the smallest price movement a currency pair can make. It is abbreviated as “percentage in point” or “price interest point.” Pips are most often used to measure gains or losses in currency pairs. Most times, a pip is equal to one-hundredth of one percent or 0.

1. The value of a pip varies depending on the currency pair you are trading. For example, one pip for the EUR/USD currency pair is 0.0001, but for the USD/JPY currency pair, one pip is 0.

2. Now let’s talk about how to calculate a pip. In order to calculate a pip, you will need to know the exchange rate of the currency pair you are trading, as well as the currency you are trading in.

For example, if you are trading the EUR/USD currency pair and the exchange rate is 1.20, then one pip would be equal to 0.0001 x 1.20, or 0.

3. Now that you know what a pip is and how to calculate it, you can understand how it affects your trading decisions. A pip can help you determine how much you are risking or gaining on a trade. It can also help you determine when to enter and exit a position.

Armed with this knowledge, you can now become a more informed trader and make better trading decisions. So, the next time you hear someone mention a pip, you will know exactly what they are talking about.

Understand Decimal Places:

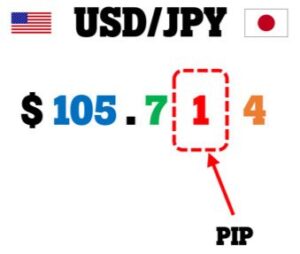

In most major currency pairs, the exchange rate is quoted in four decimal places. The exception is the Japanese Yen (JPY) pairs, which are typically quoted in two decimal places.

JPY Pips Value Exception

Pip in Forex Trading Japanese yen (JPY) pairs are quoted with 2 decimal places, marking a notable exception to the four decimal place rules. USD/JPY, it is 0.01. 1 For currency pairs such as the EUR/JPY and USD/JPY, the value of a pip is 1/100 divided by the exchange rate. For example, if the EUR/JPY is quoted as 132.62, one pip is 1/100 ÷ 132.62 = 0.0000754. With a lot size of 100,000 euros, the value of one pip (in USD) would be $7.54.

Cross Pairs:

For currency pairs that don’t involve the US Dollar, the pip value is still based on the fourth decimal place, but you might need to convert it to your account’s base currency to determine the actual profit/loss in your account currency.

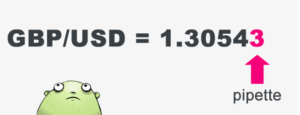

Pipettes:

Some trading platforms use an additional decimal place, often referred to as a “pipette” or “fractional pip,” which is one-tenth of a pip. So, if the EUR/USD moved from 1.12345 to 1.12346, it moved one pipette.

You can also Read – Forex Trading in India: A Beginner’s Guide

How to Calculating Pip Value

To count Pip in Forex Trading, you focus on the last decimal place movement. Each movement of 0.0001 (fourth decimal place) represents one Pip in Forex Trading. If the exchange rate changes from 1.12345 to 1.12355, it has moved 10 pips.

Example calculation:

Initial rate: 1.12345

New rate: 1.12355

Pip movement: 1.12355 – 1.12345 = 0.00010 = 10 pips

Calculating Profit/Loss:

The value of a Pip in Forex Trading can vary depending on the lot size (volume) you’re trading and the currency pair. Most brokers offer a “pip value calculator” to help you determine the value of a Pip in Forex Trading in your account currency.

For example, if you’re trading a standard lot (100,000 units) of EUR/USD, and each pip is worth $10, if the trade moves 20 pips in your favourr, you would earn 20 pips * $10/pip = $200.

Setting Stop-Loss and Take-Profit:

Traders often use pips to set stop-loss and take-profit levels. If you want to set a stop-loss 30 pips away from your entry point, you’d calculate the actual price level using the pip value.

If you entered a trade at 1.12345 and want a stop-loss 30 pips away:

Stop-loss price = 1.12345 – 0.00300 (30 pips * 0.0001) = 1.12045

Remember that while Pip in Forex Trading are essential for measuring price movement, trading involves risks, and proper risk management and understanding of the market are crucial. Different brokers and trading platforms might have slight variations in pip calculations, so it’s important to familiarize yourself with the specific platform you’re using.